Now Enrolling for Summer & Fall 2024 CPA Review Classes

Overview of the Educational Requirements to Test and License for the CPA

Download RequirementsBelow are the details of the educational requirements to test for the CPA exam and obtain your CPA license. These are updated as of January 2024. Note that the Texas State Board of Public Accountancy (TSBPA) has the final assessment of each applicant’s qualifications. You should review the most current rules on the TSBPA’s website at https://www.tsbpa.texas.gov/.

Overview

| Requirement to Test | Requirement for License | ||||

|---|---|---|---|---|---|

| Bachelor’s Degree | ✓ | ||||

| 120 college credit hours that include: | ✓ | ||||

| 21 Cr. Hours of upper-level accounting as follows: | |||||

| 12 Cr. Hours of Category 1 classes listed below: | |||||

| 3 Cr. Hours Financial Accounting (ACCT 3331 or ACCT 6330) | ✓ | ||||

| 3 Cr. Hours Financial Auditing (ACCT 4334 or ACCT 6334) | ✓ | ||||

| 3 Cr. Hours Taxation (ACCT 3350 or ACCT 6350) | ✓ | ||||

| 3 Cr Hours Accounting Information Systems or Accounting Data Analytics (ACCT 3312 or ACCT 3322 or ACCT 4342 or ACCT 6338 or ACCT 6374) | ✓ | ||||

| 9 Cr. Hours of Category of other approved upper-level accounting classes (Category 2) (See Note A) | ✓ | ||||

| 24 Cr. Hours of Upper-Level Business courses (See Note B) | ✓ | ||||

| Communications: 2 Cr Hours of Accounting or Business communication included in the accounting or business hours above. (See UTD’s Approved List) | ✓ | ||||

| 150 college credits that include: (See Note C) | ✓ | ||||

| All the requirements to test plus: | ✓ | ||||

| 6 additional Cr. Hours of approved upper-level accounting courses. (See Note D) | ✓ | ||||

| Research: 2 Cr Hours of Accounting Research included in the 21 Accounting hours above. (See UTD’s Approved List) | ✓ | ||||

| 3 Cr. Hours of Approved Accounting Ethics (ACCT 6335) | ✓ | ||||

Note A: Additional 9 Cr. Hours of Accounting to Test: The additional 9 Cr. Hours of Accounting can be from any approved upper-level accounting class not to exceed 6 additional hours of financial/intermediate accounting or 9 additional hours of taxation, accounting information systems; or accounting data analytics; and 3 cr. hours of accounting independent study.

Note B: Business Hours: The 24 credit hours should be upper-level business courses with the exception that economics and statistics can be at any level. Students cannot use more than 6 credit hours in any one subject.

Note C: Total 150 college hours: The 150 college hours can include up to 3 hours of independent study and 6 hours of internship credit. For hours earned after completion of a Bachelor’s degree, note that these hours must be obtained from a recognized institution of Higher Education or from an approved set of accounting and business courses at approved Texas Community colleges only.

Note D: Total 150 college hours: The additional 6 Cr. Hours of Accounting needed to license can be from any approved upper-level accounting class, not to exceed 9 additional hours of taxation, 9 cr. hours of accounting data analytics; and 3 cr. hours of accounting independent study.

Approved Accounting Classes:

As of January 2024, the following courses are on UTD’s approved list noting the category for the initial Application of Intent.

| Approved Upper-level Accounting Classes | Category for AOI (1 or 2) |

Cr. Hours of Research (R) or Communication (C) |

|---|---|---|

| ACCT 3312 Fundamentals of Accounting Analytics | 1 or 2 | |

| ACCT 3322 Integrated Accounting Information Systems | 1 or 2 | |

| ACCT 3331 Intermediate Financial Accounting I | 1 | |

| ACCT 3332 Intermediate Financial Accounting II | 2 | |

| ACCT 3341 Cost Management Systems | 2 | |

| ACCT 3350 Fundamentals of Taxation | 1 | |

| ACCT 4301 Database Systems | 2 | |

| ACCT 4302 Accounting Research | 2 | |

| ACCT 4334 Auditing | 1 | |

| ACCT 4336 Financial Statement Analysis | 2 | |

| ACCT 4337 Business Valuation | 2 | |

| ACCT 4342 Acct Information Systems & Financial Reporting | 1 or 2 | |

| ACCT 4v81 Individual Study in Accounting | 2 |

| Approved Upper-level Accounting Classes | Category for AOI (1 or 2) |

Cr. Hours of Research (R) or Communication (C) |

|---|---|---|

| ACCT 6313 Cybersecurity Fundamentals | 2 | |

| ACCT 6321 Database Applications for Business Analytics | 2 | |

| ACCT 6330 Intermediate Financial Accounting I | 1 | |

| ACCT 6331 Cost Accounting Foundations and Evolutions | 2 | |

| ACCT 6332 Intermediate Financial Accounting III | 2 | |

| ACCT 6333 Advanced Financial Reporting | 2 | |

| ACCT 6334 Auditing | 1 | |

| ACCT 6336 Information Technology Audit & Risk Management | 2 | |

| ACCT 6338 Accounting System Integration and Configuration | 1 or 2 | |

| ACCT 6340 System Analysis and Project Management | 2 | |

| ACCT 6341 Planning, Control, and Performance Evaluations | 2 | |

| ACCT 6343 Accounting Information Systems | 1 | |

| ACCT 6344 Financial Statement Analysis | 2 | |

| ACCT 6345 Business Valuation | 2 | |

| ACCT 6350 Fundamentals of Taxation I | 1 | |

| ACCT 6353 Fundamentals of Taxation II | 2 | |

| ACCT 6354 Taxation and Planning of Pass-through Entities | 2 | |

| ACCT 6356 Tax Research | 2 | |

| ACCT 6365 Governmental and Not-for-Profit Accounting | 2 | |

| ACCT 6367 Multijurisdictional Taxation | 2 | |

| ACCT 6374 Advanced Data Analytics for Accountants & Auditors | 1 or 2 | |

| ACCT 6377 Corporate Governance | 2 | |

| ACCT 6380 Internal Audit | 2 | |

| ACCT 6383 Fraud Examination | 2 | |

| ACCT 6384 Analytical Reviews Using Audit Software | 2 | |

| ACCT 6386 Governance, Risk Management and Compliance | 2 | |

| ACCT 6392 Advanced Auditing | 2 | |

| ACCT 6393 Sustainability and the Role of Modern Corp. | 2 | |

| ACCT 6v90 Special Topics in Accounting | 2 |

Research and Communication Courses:

Accounting Research and Analysis: As part of the required hours of accounting coursework needed to test (2) two semester hours are required in accounting research and analysis. The semester hours may be included in the accounting hour requirement. Courses may change over time.

| Course Number | Course Name | Research Credit Hours | Effective Start Date for Research Credit | Effective End Date for Research Credit |

|---|---|---|---|---|

| ACCT 3350 | Fundamentals of Taxation I | 1 cr hr – research | Fall 2023 | currently still active |

| ACCT 4302 | Accounting Research | 1 cr hr – research | Fall 2021 | currently still active |

| ACCT 4334 | Auditing | 1 cr hr – research | Fall 2011 | currently still active |

| ACCT 6333 | Advanced Financial Reporting | 1 cr hr – research | Fall 2014 | currently still active |

| ACCT 6334 – See Note | Auditing | 1 cr hr – research | Spring 2022 – See Note Below | currently still active |

| ACCT 6356 | Tax Research | 2 cr hr – research | currently still active | |

| ACCT 6392 | Advanced Auditing | 1 cr hr – research | Fall 2021 | currently still active |

| Course Number | Course Name | Research Credit Hours | Effective Start Date for Research Credit | Effective End Date for Research Credit |

|---|---|---|---|---|

| ACCT 3350 | Fundamentals of Taxation I | 1 cr hr – research | Fall 2012 | Summer 2021 |

| ACCT 3351 | Individual Taxation | 1 cr hr – research | Fall 2011 | Summer 2012 |

| ACCT 6350 – See Note | Fundamentals of Taxation I | 1 cr hr – research | Fall 2012 – See Note Below | Summer 2021 |

| ACCT 6351 | Individual Taxation | 1 cr hr – research | Fall 2011 | Summer 2012 |

| ACCT 6334 – See Note | Auditing | 1 cr hr – research | Fall 2011 – See Note Below | Summer 2019 |

| ACCT 6382 | Advanced Internal Auditing | 1 cr hr – research | Fall 2014 | Summer 2021 |

| ACCT 6373 | Advanced External Auditing | 1 cr hr – research | Fall 2015 | Summer 2021 |

NOTE: ACCT 6334 – Auditing and ACCT 6350 – Fundamentals of Tax I have counted for research hours and communication hours at different times. Based on when you took the class it may satisfy different requirements for CPA eligibility. Also note that the graduate and undergraduate versions may be treated differently as well. Please review your class and dates carefully.

Required Communication Coursework

As part of the 24 hours of business coursework needed, (2) two credit hours of either accounting communications or business communications will be required. The following course(s) meet the Board’s requirements for a discrete (stand-alone) course in accounting communications or business communications:

| Course Number | Course Name | Communication Credit Hours | Effective Start Date for Communication Credit | Effective End Date for Communication Credit |

|---|---|---|---|---|

| BCOM 3300 | Professionalism and Communication in Business | 1 cr hr – communication | Fall 2021 | currently still active |

| ACCT 4342 | Accounting Information Systems | 1 cr hr – communication | Fall 2021 | currently still active |

| ACCT 6350 | Fundamentals of Taxation I | 1 cr hr – communication | Fall 2021 – See Note Below | currently still active |

| ACCT 6353 | Federal Taxation II | 1 cr hr – communication | Fall 2019 | currently still active |

| ACCT 6386 | Governance, Risk Management and Compliance | 1 cr hr – communication | Fall 2021 | currently still active |

| ACCT 6388 | Accounting Communications | 2 cr hrs – communication | Fall 2014 | currently still active |

| Course Number | Course Name | Communication Credit Hours | Effective Start Date for Communication Credit | Effective End Date for Communication Credit |

|---|---|---|---|---|

| ACCT/BA/BCOM 3311 | Business Communications | 2 cr hrs – communication | Fall 2011 | Summer 2014 |

| BCOM 3310 | Business Communications | 2 cr hrs – communication | Fall 2014 | Summer 2021 |

| ACCT 6203 | Professional Acct Communications | 1 cr hr – communication | Fall 2011 | Spring 2014 |

| ACCT 6334 | Auditing | 1 cr hr – communication | Fall 2019 – See Note Below | Fall 2021 |

NOTE: ACCT 6334 – Auditing and ACCT 6350 – Fundamentals of Tax I have counted for research hours and communication hours at different times. Based on when you took the class it may satisfy different requirements for CPA eligibility. Also note that the graduate and undergraduate versions may be treated differently as well. Please review your class and dates carefully.

Ethics

In order to get your license, you must have 3 hours of Board approved accounting ethics. That class at UTD is ACCT 6335, Ethics for Professional Accountants.

Other Course Information (Internship, Repeat classes and CPA review classes)

Internships: Students often take internships for credit. Here is how internships will be applied for educational purposes for the CPA exam.

| Can I use an internship for________? (Accounting or Business) | |

|---|---|

| Accounting hours to test | No |

| Accounting hours to license | No |

| 120 hours to test | Yes – up to 3 credit hours of an internship can be included in the total hours to test. |

| 150 hours to license | Yes – up to 3 additional (6 max) credit hours of an internship can be included in the total hours needed hours to license. |

At UTD, the internship must be taken after 12 semester hours of upper-level accounting coursework has been completed. For international students, 2 long semesters must be completed before starting an internship. You must have GPA of 3.0 or better to complete an internship. All internships must be approved by the career center and the undergraduate or graduate accounting area before you are enrolled. Please visit the Career Center for detailed requirements at http://www.utdallas.edu/career/internships/. For questions about starting the approval process, contact the Career Center at careercenter@utdallas.edu. For questions regarding the internship course, specific accounting duties, and waivers, please contact Tiffany Bortz (for undergraduate) ( tabortz@utdallas.edu ) or msacctflexintern@utdallas.edu for graduate internship. For questions about course registration, please contact your JSOM Advisor ( https://jindal.utdallas.edu/advising/ ). See the TSBPA FAQ for additional internship information.

Repeat Courses and CPA Review Courses:

-

Repeated Coursework: The TSBPA states that credit will not be given for repeated courses for coursework in accounting, business or total hours at any level (Undergraduate or Graduate)

-

CPA Review Class: Additionally, CPA review classes do not count for upper-level accounting hours and cannot be included in the 150 hour total hour requirement.

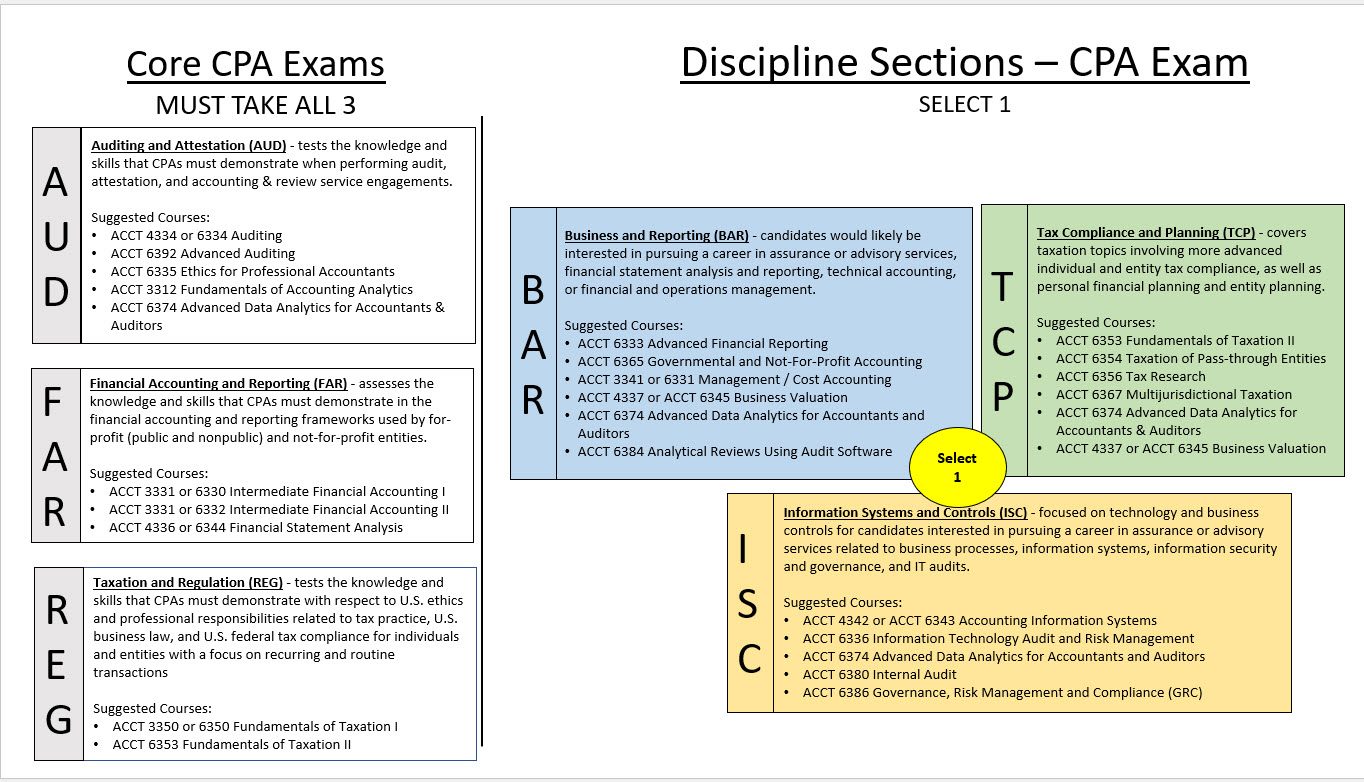

How do classes map to the parts of the CPA exam?

See the image below for the suggested classes that map to the core and disciple parts of the CPA exam.

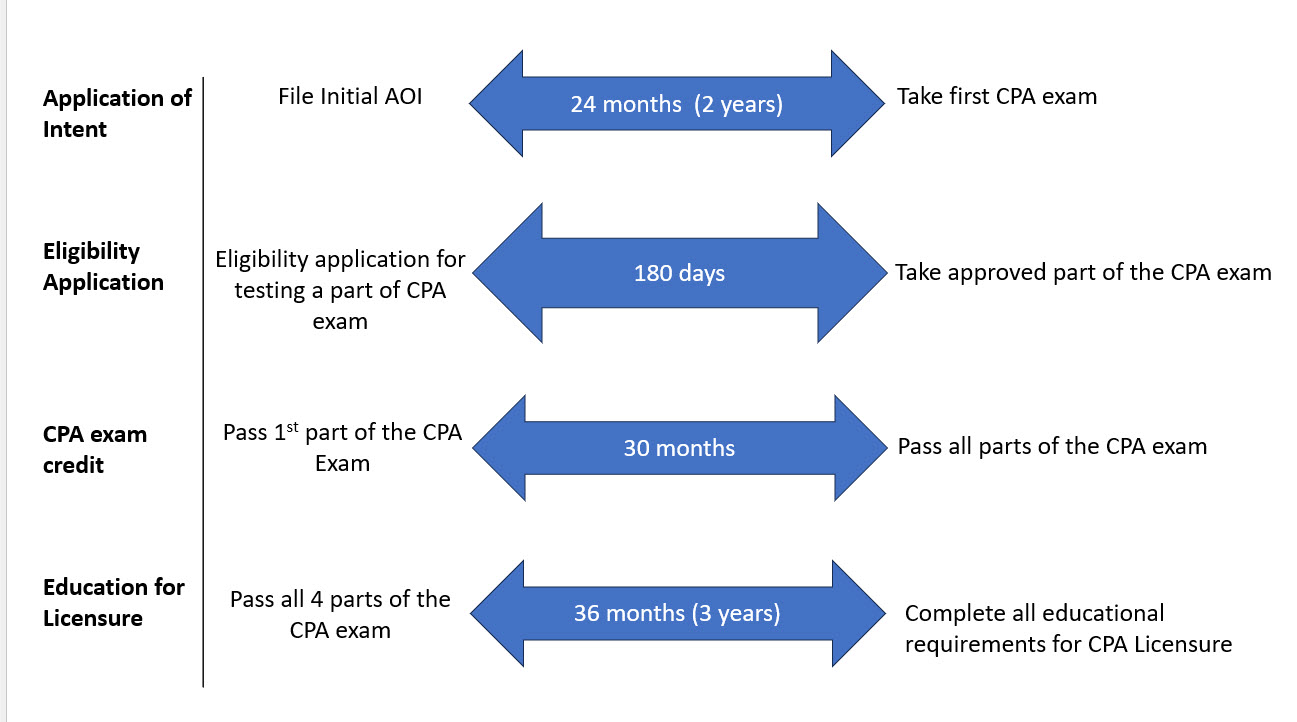

Timelines for the CPA:

There are several documents and steps that must be completed as part of the testing and licensing process. Here is a summary of some of the key timelines.

For more information about the material tested in each part of the Uniform CPA examination, please visit the AICPA’ website at:https://www.thiswaytocpa.com/segmented-landing/exam-101/