Now Enrolling for Summer & Fall 2024 CPA Review Classes

CPA Exam Overview

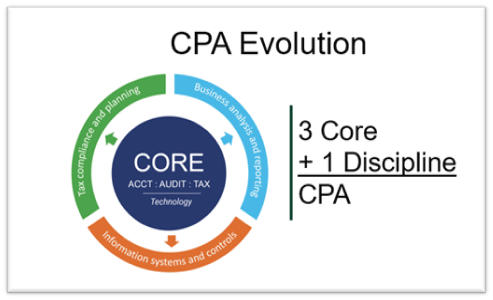

Welcome to CPA Evolution (January 2024)

What is CPA Evolution?

The CPA Evolution transforms the CPA licensure model to recognize the rapidly changing skills and competencies the practice of accounting requires today and will require in the future. As a result of this evolution, all students will take 3 core CPA exams and choose the 4th exam from a group of possible disciplines. We will call this model 3 + 1 = CPA

The Core CPA Exams:

All CPA exam candidates testing for the CPA must take and pass the 3 core CPA exams.

| AUD | FAR | REG |

|---|---|---|

| Auditing and Attestation (AUD) – tests the knowledge and skills that CPAs must demonstrate when performing audit, attestation, and accounting & review service engagements. |

Financial Accounting and Reporting (FAR) – assesses the knowledge and skills that CPAs must demonstrate in the financial accounting and reporting frameworks used by for-profit (public and nonpublic) and not-for-profit entities |

Taxation and Regulation (REG) – tests the knowledge and skills that CPAs must demonstrate with respect to U.S. ethics and professional responsibilities related to tax practice, U.S. business law, and U.S. federal tax compliance for individuals and entities with a focus on recurring and routine transactions. |

| Ethics, Professional Responsibilities and General Principles 15–25% |

Financial Reporting 30–40% |

Ethics, Professional Responsibilities and Federal Tax Procedures 10–20% |

| Assessing Risk and Developing a Planned Response 25–35% |

Select Balance Sheet Accounts 30–40% |

Business Law 15–25% |

| Performing Further Procedures and Obtaining Evidence 30–40% |

Select Transactions 25–35% |

Federal Taxation of Property Transactions 5–15% |

| Forming Conclusions and Reporting 10–20% |

Federal Taxation of Property Transactions 5–15% |

|

| Federal Taxation of Entities (including tax preparation) 23–33% |

The Discipline Choice:

All CPA exam candidates testing for the CPA must take and pass one of the CPA exam disciplines. The choice is up to the candidate.

| BAR | TCP | ISC |

|---|---|---|

| Business and Reporting (BAR) – candidates would likely be interested in pursuing a career in assurance or advisory services, financial statement analysis and reporting, technical accounting, or financial and operations management. |

Tax Compliance & Planning (TCP)- focuses on more advanced individual and entity tax compliance, plus additional content focused on personal financial planning and entity planning. |

Information Systems and Controls (ISC) – focused on technology and business controls for candidates interested in pursuing a career in assurance or advisory services related to business processes, information systems, information security and governance, and IT audits. |

| Business Analysis 40–50% |

Tax Compliance and Planning for Individuals and Personal Financial Planning 30–40% |

Information Systems and Data Management 35–45% |

| Technical Accounting and Reporting 35–45% |

Entity Tax Compliance 30–40% |

Security, Confidentiality and Privacy 35–45% |

| State and Local Governments 10–20% |

Entity Tax Planning 10–20% |

Considerations for System and Organization Controls (SOC) Engagements 15–25% |

| Property Transactions (disposition of assets) 10–20% |

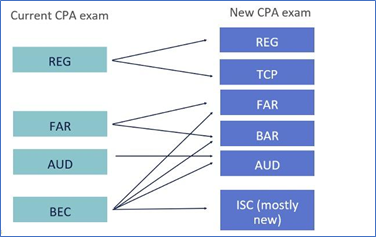

For those that passed a part of the CPA exam prior to Jan 1, 2024: For anyone who has passed a part of the CPA exam before January 1, 2024 there is a transition plan to the new exam. See the table below how parts passed prior to 2024 will be transitioned to credits in 2024.

| Part passed prior to 2024 | Credit Awarded for 2024 |

|---|---|

| AUD | AUD Core |

| FAR | FAR Core |

| REG | REG Core |

| BEC | You will get credit for passing the discipline and will not need to take any discipline test |

CPA Evolution Exam Blueprints:

To help you better prepare for the exam, please see the exam blueprints on the AICPA’s website, which provide clarity in the presentation of content, skills, and related representative tasks that may be tested on the exam.

Exam Blueprints

General CPA Exam Information

- CPA exam Sections – 4 (3 Core + 1 Discipline)

- Passing Score – 75

- Timeline to pass 4 parts – Effective Jan 1, 2024, once a candidate passes a part, they have 30 months to complete all the rest of the sections.

Exam Structure: Below is the makeup of the new CPA exam and score weighting (CORE and Disciplines).

| Section | Section time | Multiple-choice questions (MCQs) | Score Weight | Task-based simulations (TBSs) | Score Weight |

|---|---|---|---|---|---|

| AUD – Core | 4 hours | 78 | 50% | 7 | 50% |

| FAR – Core | 4 hours | 50 | 50% | 7 | 50% |

| REG – Core | 4 hours | 72 | 50% | 8 | 50% |

| BAR – Discipline | 4 hours | 50 | 50% | 7 | 50% |

| ISC – Discipline | 4 hours | 78 | 60% | 7 | 40% |

| TCP– Discipline | 4 hours | 48 | 50% | 7 | 50% |

| Section | Remembering & Understanding | Application | Analysis | Evaluation |

|---|---|---|---|---|

| AUD – Core | 30% – 40% | 30% – 40% | 15% – 25% | 5% – 15% |

| FAR – Core | 5% – 15% | 45% – 55% | 35% – 45% | – |

| REG – Core | 25% – 35% | 35% – 45% | 25% – 35% | – |

| BAR – Discipline | 10% – 20% | 45% – 55% | 30% – 40% | – |

| ISC – Discipline | 55% – 65% | 10% – 20% | 10% – 20% | – |

| TCP– Discipline | 5% – 15% | 50% – 60% | 30% – 40% | – |

Skill Allocation Definition:

- Evaluation: The examination or assessment of problems, and use of judgment to draw conclusions.

- Analysis: The examination and study of the interrelationships of separate areas to identify causes and find evidence to support inferences.

- Application: The use or demonstration of knowledge, concepts, or techniques.

- Remembering & Understanding: The perception and comprehension of the significance of an area utilizing knowledge gained.

- The AICPA reaffirmed that “data and technology” will be assessed in all Core and Discipline Exam sections. This will be done by focusing on understanding how data is structured and how information flows through IT systems and business practices; determining methods to transform data to be useful for decision making; verifying completeness and accuracy of source data; and using the outputs of automated tools, visualizations, and data analytic techniques.

- Candidates are not required to generate reports or visualizations, nor use data analytics software applications.

- All Core and Discipline sections will test “higher-order skills,” including critical thinking, problem-solving, analytical ability, professional skepticism and research.

- Most of the content that was previously assessed in the BEC section has been moved to the AUD, FAR, BAR and ISC sections, except the written communication item which will be completely removed.

- The content from the current FAR section will be split between the new FAR and BAR sections.

- Content from the current REG section will be split between the new REG and TCP sections.

- Some content in the current FAR and REG sections will now be tested in the BAR and TCP Discipline sections, respectively.

Testing Dates and Score Release for 2024: Due to the new exams, there will be limited time windows to take each part of the exam and there will be a delay in score reporting for 2024.

| Quarter | Core Test Dates | Core Score Reports | Discipline Test Dates | Discipline Score Reports |

| 24 – Qtr 1 | Jan 10 – Mar 26 | May 14 – June 4 | Jan 10 – Feb 6 | Mar 26 – Apr 16 |

| 24 – Qtr 2 | Apr 1 – June 25 | Aug 1 | Apr 20 – May 19 | June 20 |

| 24 – Qtr 3 | Jul 1 – Sept 25 | Nov 1 | Jul 1 – Jul 31 | Sept 3 |

| 24 – Qtr 4 | Oct 1 – Dec 26 | Feb 2025 | Oct 1 – Oct 31 | Dec 3 |

CPA Links and More Information

CPA Exam Links

Navigating the CPA Exam Application ProcessExcellent information and advice to get through all the steps in the application process.

This Way to CPACollege students and CPA Candidates: take a look at this website specifically designed to give you the information and community needed to prepare for, take and pass the CPA Exam!

Finding other States’ CPA Exam and Licensing RequirementsLearn about the requirements of various states, view application video tutorials, and find out how to check your scores online.

Candidate Bulletin: Information for CPA Exam ApplicantsEssential guide to the entire process of becoming a CPA.

CPA Requirements (Texas)On your way to Texas CPA: Video outlining accounting career options and the qualifications and requirements to get your Texas CPA license.

AICPA Exam ResourcesInformation from the American Institute of CPAs (AICPA) on how the CPA exam is structured and administrated.

CPA Exam FAQDownloadable PDF of FAQs